A few weeks ago, on July 4th weekend, it was close to 100º in many places across Texas. Some were concerned about how hot it might get as we approached the dreaded last two weeks of July and first two weeks of August. As it turns out, the summer of 2020 has been mild, and the weather has actually been quite nice!

On average, there are 18 days above 100º each summer in the DFW area. So far this year, there’s only been one day where the temperature exceeded triple digits (July 13th), and no days in the 10-day forecast are expected to rise above 97º. These mild temperatures have kept the total electricity demand, except for July 13th, significantly below the critical limit of generation reserves the state deems safe for the electricity grid. An unseasonable amount of wind generation on July 13th was the largest contributing factor that enabled supplies to keep up with demand on that day.

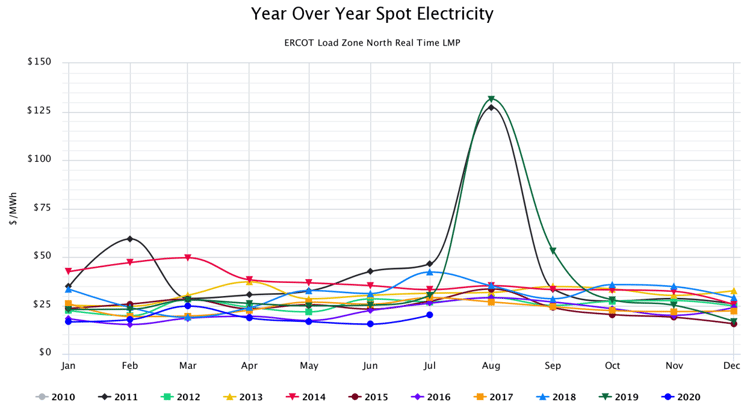

With enough generating capacity in reserve, there have only been 2 hours this month where wholesale electricity prices in North Texas have climbed above 20¢ per kWh, even during the peak afternoon hours. This has made the average real-time index price for both June and July the least expensive months of the past decade, as shown in the blue line in Figure 1.

Figure 1: Year Over Year Spot Electricity, from 5

This is good news for electricity buyers. For those taking electricity prices at the Real Time Index, times have never been better than the last two months. For those who prefer the budget stability of fixed prices, these very low index prices and mild weather forecasts have put significant downward pressure on short-term forward prices.

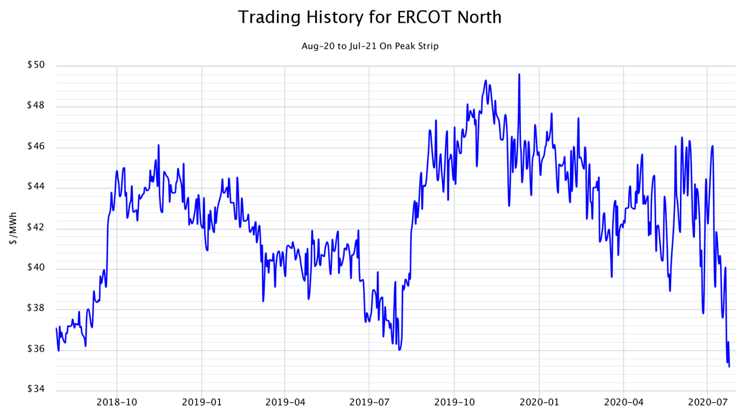

Figure 2 shows forward wholesale electricity prices for a 12-month period beginning in August 2020. This chart shows that as of July 27th, prices in North Texas were at their 24-month lows.

Figure 2: Trading History for ERCOT North, Aug-20 to Jul-21 On Peak Strip, from 5

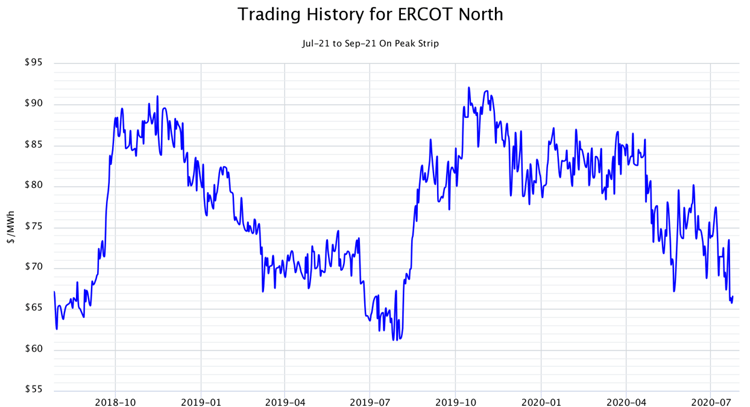

This downward pressure on electricity prices also extends into next summer (June – September 2021). Figure 3 shows that prices for the summer of 2021 are trading just 0.5¢ per kWh higher than last summer’s low, which was set also in late July 2019.

Figure 3: Trading History for ERCOT North, Jul-21 to Sep-21 On Peak Strip, from 5

Clients with open electricity positions (where electricity has not been purchased) for the balance of this summer or next summer should gather and evaluate prices now. Low wholesale summer power prices should incentivize buyers to consider locking in some or portions of future electricity needs over the next 18 months.