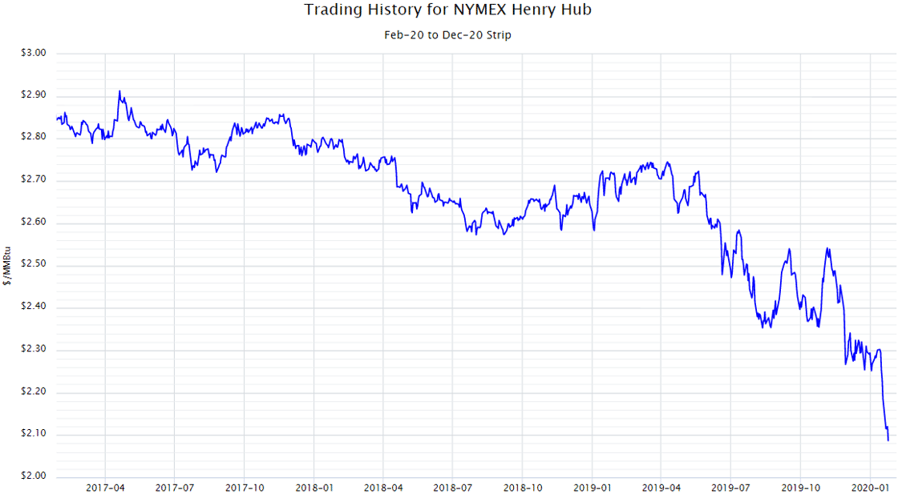

As you have likely heard, national, and even global, natural gas prices have been falling. In fact, NYMEX futures prices for the rest of this winter are all trading below $2.00/MMBtu and as shown in Figure 1, the balance of 2020 (Feb – Dec) is trading at $2.10/MMBtu. These are the lowest prices we have seen since late winter/early spring of 2016. Prices in the calendar year 2021 haven’t decreased as much, but are trading at all-time lows of $2.35/MMBtu.

Figure 1: Trading History for NYMEX Henry Hub, by 5

Figure 1: Trading History for NYMEX Henry Hub, by 5

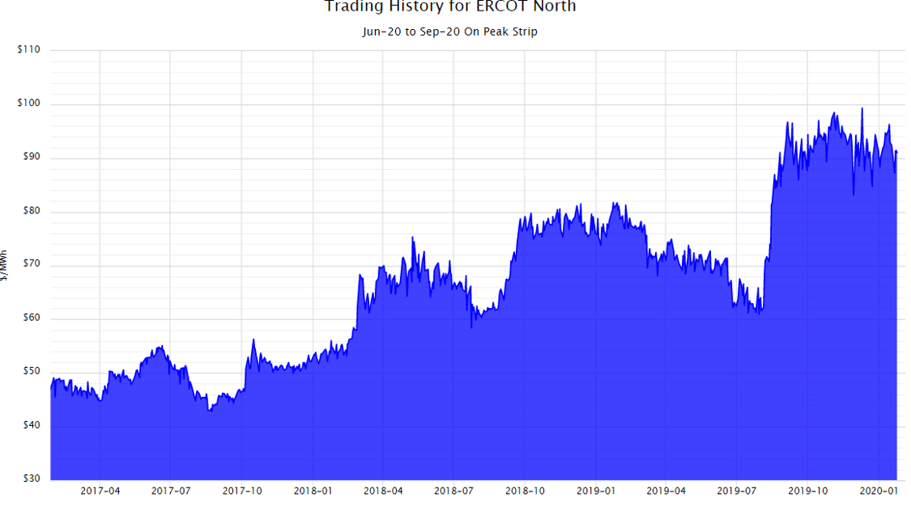

Traditionally, these very inexpensive natural gas prices would also drive down electricity prices in Texas, similar to what was observed in 2016 and 2017. However, this time history is not repeating itself. The main difference between 2016 and 2020 is the state of the Texas electric grid.

After the power price spikes of this past August, caused by the low Reserve Margin, the market is no longer as concerned with low fuel prices. Today, the market’s broader concern is having enough generating capacity to meet peak summer-time demand. As shown in Figure 2, this has caused forward power prices for this summer (Jun – Sep) to remain elevated, almost identical to where they were this past September.

Figure 2: Trading History for ERCOT North , by 5

Figure 2: Trading History for ERCOT North , by 5

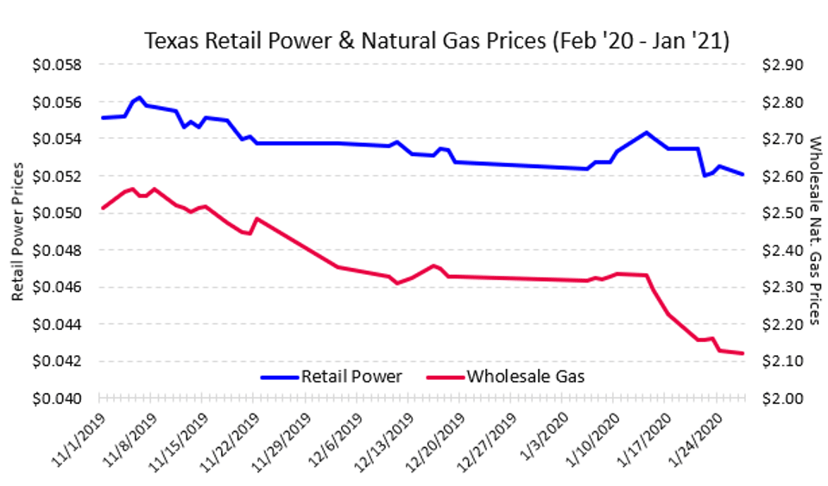

Figure 3 shows how wholesale natural gas prices have begun to separate from retail electricity prices in Texas. Lower natural gas prices are decreasing wholesale electricity prices only in the non-summer months, where the state has enough excess generating capacity to meet peak demand. Most of the electricity in Texas is used in the summer.

Even though power prices might be depressed in the non-summer months, the uncertainty around enough electricity being available this summer (and beyond) is keeping retail power prices elevated and not following the overall downward trend of gas prices.

Figure 3: Texas Retail Power & Natural Gas Prices (Feb '20 - '21), by 5

Figure 3: Texas Retail Power & Natural Gas Prices (Feb '20 - '21), by 5