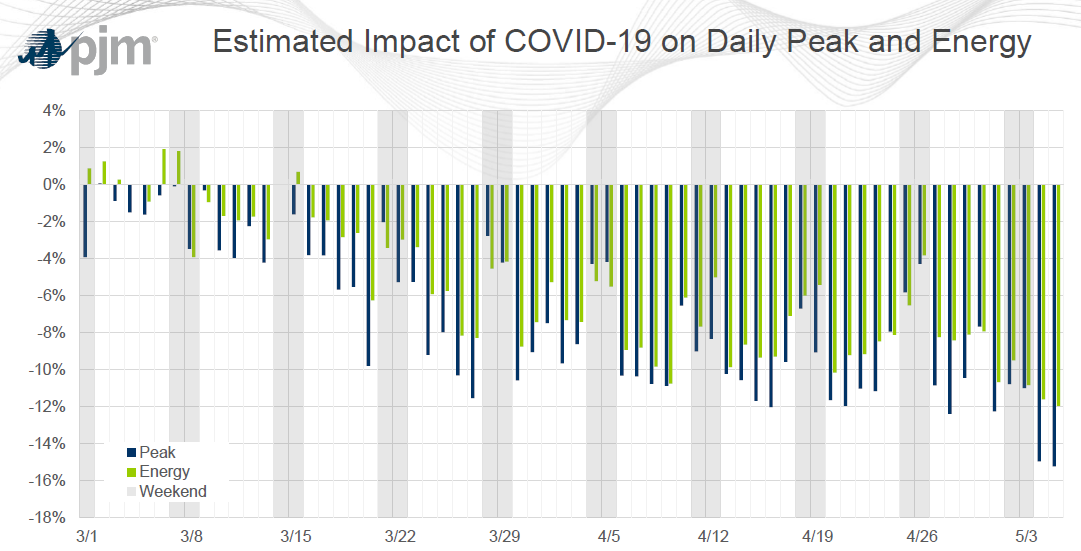

PJM released its initial report on electric load reduction as a result of COVID-19. Figure 1 shows the decrease in peak demand (blue bar) and overall electricity usage (green bar) through the middle of May, with weekends shaded in gray. On average, the weekday peak demand (in kW or MW) fell between 6.5% to 15.2%. Overall energy usage (in kWh or MWh) was not as significantly affected and was down by approximately 8% since March 24th. Not surprisingly, the weekends experienced the smallest reduction to demand and consumption.

Figure 1: Estimated Impact of COVID-19 on Daily Peak and Energy, by pjm.com

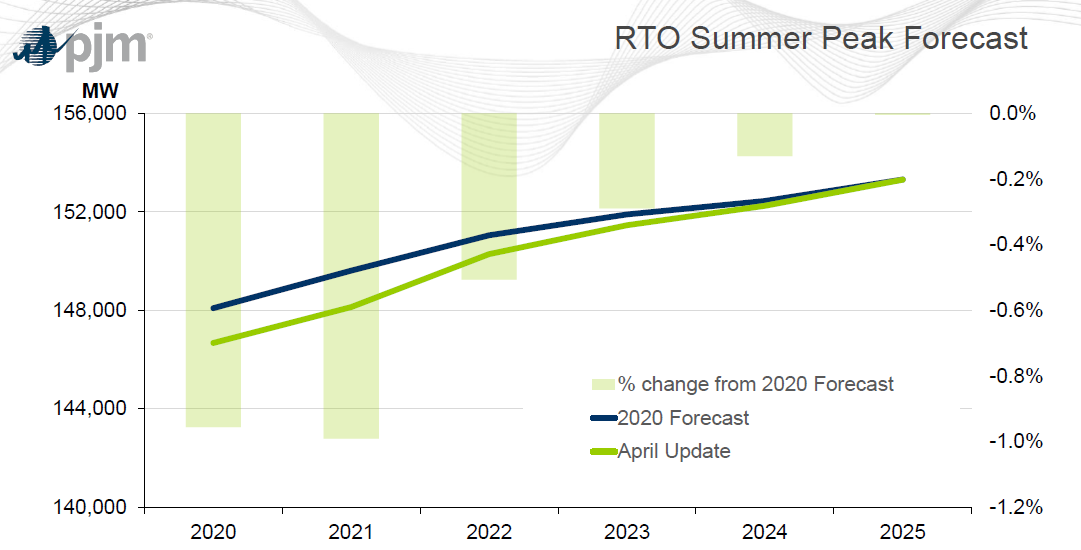

Another part of PJM’s report forecasts when the electricity grid might return to levels before the Coronavirus outbreak. Figure 2 shows PJM’s summer peak demand forecast for the next five years. The original forecast (pre-COVID) predicted that peak summer load in PJM would grow from 148,000 MWs in 2020 to approximately 153,000 MWs in 2025. The green bar indicates the percent decrease in forecasted summer load as a result of the demand destruction caused by COVID-19. PJM is now expecting a decrease of a little less than 1% of its peak summer demand over the next two years. The green line is a reforecast that was done in April to show the revised load growth in PJM. This model shows that PJM predicts that it will take five years for the peak summer electricity load to return to pre-Coronavirus levels.

More details on this analysis from PJM can be found here.

Figure 1: RTO Summer Peak Forecast, by pjm.com