The last 30 days have shown how the stability of the power grid in Texas is influenced by the wind. In late July, Hurricane Hanna came onshore near Kenedy County as a Category 1 storm with maximum sustained winds of around 90 mph. Its destructive force was felt as it moved across the Rio Grande Valley, causing local structural damage and outages from downed trees and powerlines. Specifically, there was significant damage to a two-mile stretch of 138,000-volt transmission line in Edinburg, just south of the 712-megawatt Magic Valley Generation Station.

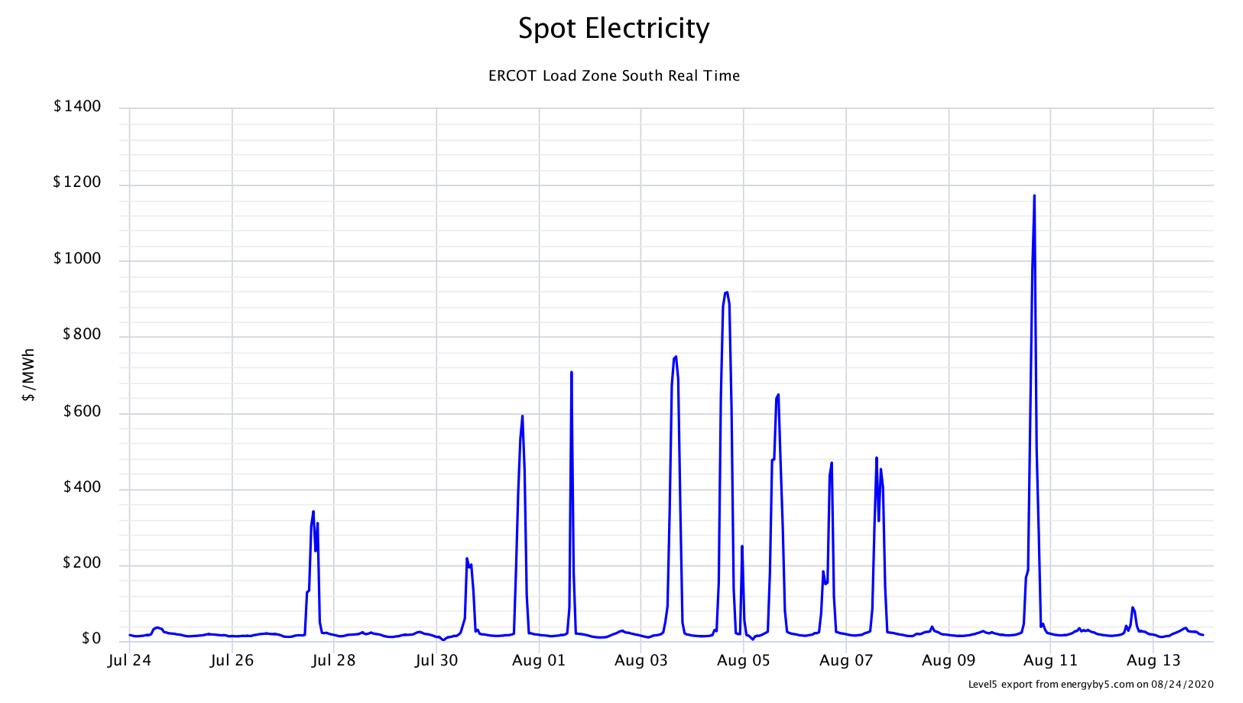

The local transmission system was crippled for the two weeks required to repair the damage from the storm. Congestion was especially high throughout the Rio Grande Valley during peak periods of demand in the afternoon and early evening hours. Energy had to be imported from Mexico across two DC ties because of insufficient transmission infrastructure and inadequate energy supplies. These constraints elevated regional spot electricity prices well above the rest of the state’s average prices. Figure 1 shows average Real Time hourly prices in ERCOT’s South Zone from July 24 through August 13. The price spikes shown in this chart all occurred in the early afternoon and evening hours when electricity demand and usage were at their peaks.

Figure 1: Spot Electricity ERCOT Load Zone South Real Time, from 5

This two-week span of Real-Time price volatility was not as bad a last summer’s August price spikes. In the South Zone, prices for July averaged just 2.5¢ per kWh, which was one of the lowest priced summer months in ERCOT’s history. Even with the majority of these spikes happening in the first week of August, this month’s average index price is just under 6¢ per kWh. While not as good as July, this August will still likely be only half as high as last August’s average price of 13¢ per kWh.

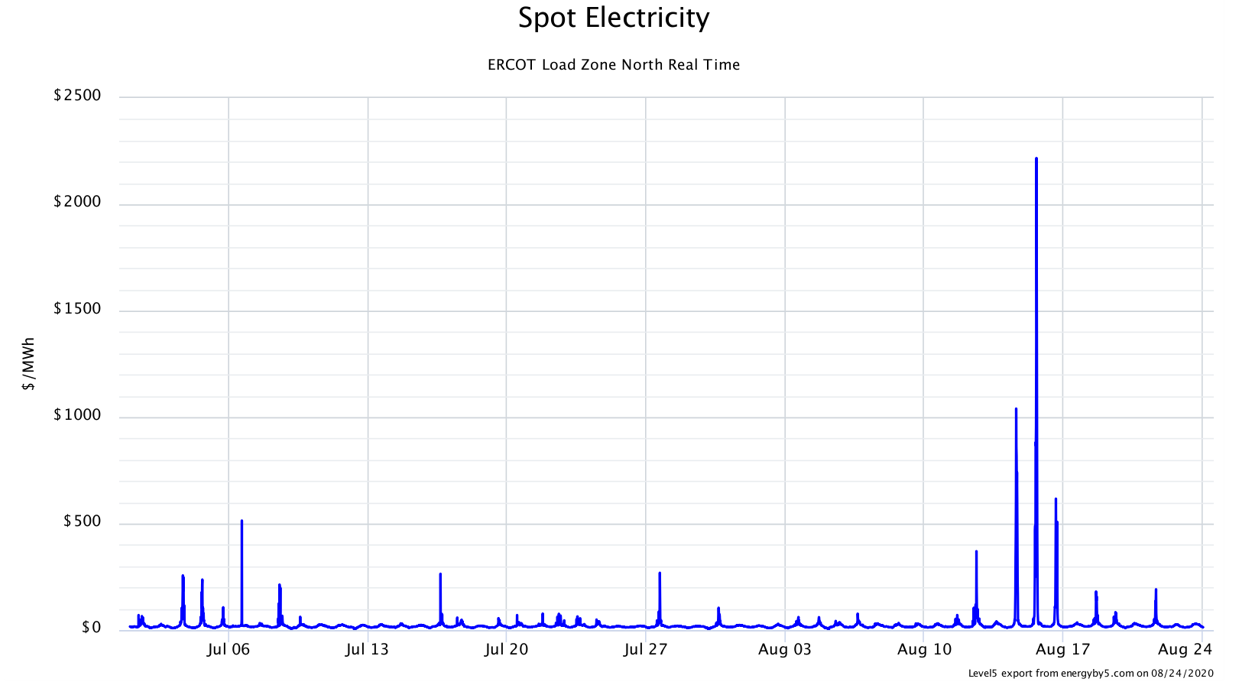

The rest of the state of Texas experienced Real Time price volatility in the second week of August. During that week, warm temperatures across the state drove up electricity demand going into the weekend of August 14th – 16th. And unlike late July, wind speeds in West Texas were not enough on Friday and Saturday afternoon to keep up with electricity demand. Even though those two days were not the highest demand days of this summer, they were the highest Real-Time price days due to the lack of wind generation. Figure 2 shows the North Zone’s Real Time index prices from July 1st through August 24th. The three spikes in the 2nd week of August reflect those periods when there was not enough wind power to meet the grid’s demand in the afternoons of Friday, August 14th through Sunday August 16th.

Figure 2: Spot Electricity ERCOT Load Zone North Real Time, from 5

So far, it appears as though this summer’s prices will be similar to the summer of 2018 where the average weekend On-Peak hours (6 AM to 10 PM) in August will be slightly more expensive than the weekday On-Peak hours. This is likely to place continued upward pressure on the forward prices for weekend On-Peak hours and downward pressure on weekday On-Peak hours into the future.

The last few weeks have shown how the wind can influence electricity customers in Texas. The destructive nature of the wind from storms and the lack of sufficient wind when the grid needs it most can have equally adverse effects on the state’s power grid. Texas has more installed wind capacity than the rest of the United States and many other countries. Unfortunately, that statistic is only meaningful when the wind blows.