On behalf of the team at 5, I am pleased to forward our market letter for the second quarter of 2020. This letter updates our analysis of COVID-19 and its impact on energy demand. It also discusses the pandemic’s impact on state renewable goals, and how FERC’s position on several important energy policy decisions could shift depending on which party wins the 2020 presidential election.

COVID-19

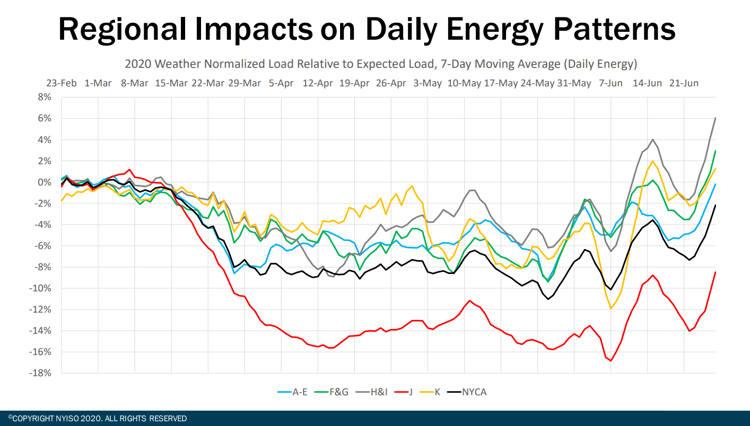

COVID-19 related load reductions are clearly reversing in New York State. After a brutal slowdown, the economy is waking up and changes in load across the state reflect this trend. Figure 1 shows usage patterns across the various load zones in New York.

Figure 1: Regional Impacts on Daily Energy Patterns, from nyiso.com

While Zone J, New York City, trails the rest of the state, the recovery tracks the decline in the virus’ spread.

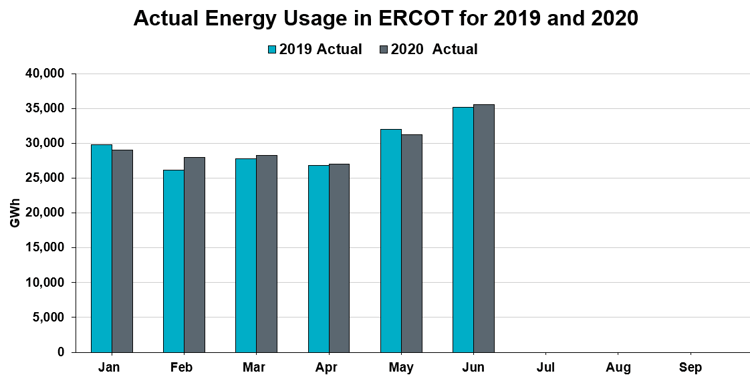

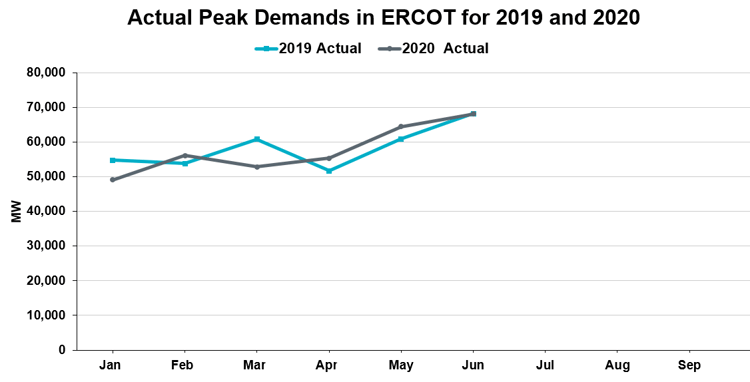

To date, Texas has not experienced a similar reduction in load. As Figures 2 and 3 below demonstrate, there is little change in Texas’ energy usage and peak demand when 2019 is compared to 2020.

Figure 2: Actual Energy Usage in ERCOT for 2019 and 2020, from ercot.com

Figure 3: Actual Peak Demands in ERCOT for 2019 and 2020, from ercot.com

Over the last few weeks, we have seen a significant spike in COVID-19 cases in Texas, but load remains steady. June’s peak usage was a few percentage points below expectations, but the drop was not material. And so far, July's usage is following suit and not showing signs any of material changes. In fact, on July 8, electric load in ERCOT was 69,450 MWs, which is higher than any time in June, and the average temperature was a relatively mild (for Texas) 93 degrees. It is too early to draw conclusions from this data; however, the difference in how load responds to the virus in New York and Texas appears significant. We will continue to monitor load changes and inform clients as we learn more about how the pandemic impacts usage.

Supplier Impact: We are also tracking how energy suppliers are reacting to the virus. At particular risk are suppliers who serve clients that have experienced significant usage decreases due to COVID-19. If the risk of such usage variations are borne by the supplier, the supplier is left with a long position (excess supply) that must be resold, usually at a loss[1]. In the initial months of the pandemic, energy suppliers, almost without exception, agreed to waive usage variation clauses[2] for customers impacted by COVID-19, even where the contracts expressly shifted the risk of usage changes to the customers.

As the pandemic drags on, however, several suppliers have revisited these earlier decisions and will no longer allow clients to exceed usage variations without penalty. We would not be surprised if we see additional changes to contract interpretation in the weeks and months ahead. If your usage is impacted by COVID-19, we recommend taking a close look at your contract’s usage restrictions. Of course, if you have any questions, please reach out to a member of our team.

COVID-19 AND STATE RENEWABLE GOALS

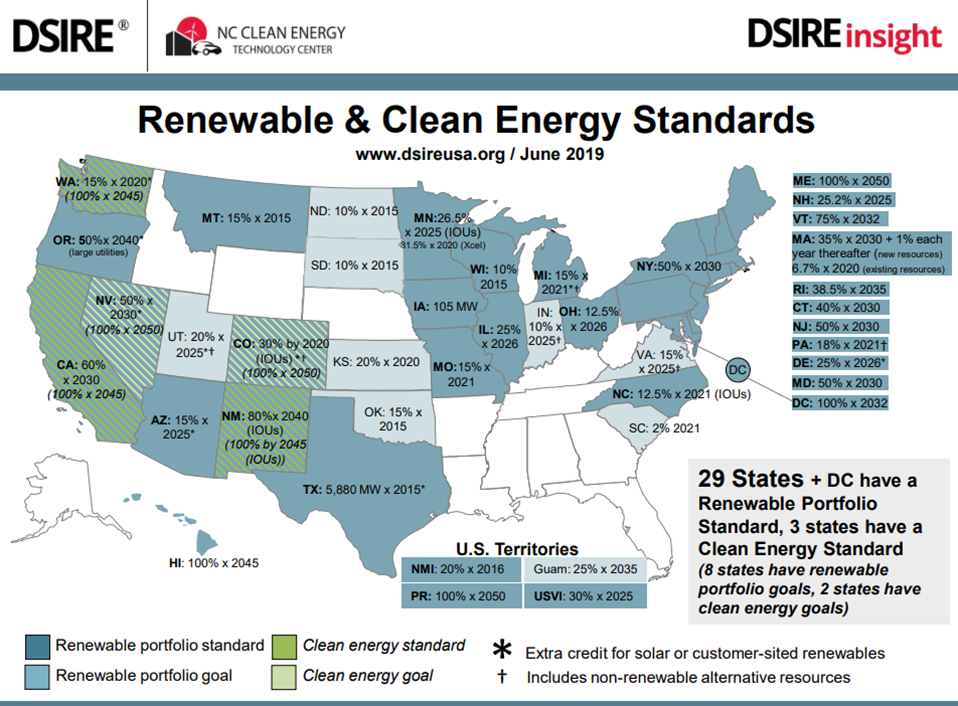

When the Trump Administration pulled back on the federal government’s efforts to address climate change, many states responded with a wide range of state initiatives. These are summarized in Figure 4. It is too early to tell if an extended pandemic will impact these state initiatives.

Figure 4: Renewable & Clean Energy Standards, from dsireusa.org

New York, one of the states hit hardest by COVID-19, will be a good test of whether a state’s appetite to address climate change is impacted by the pandemic. New York’s renewable commitments include:

- 70% of load to be served by renewable resources by 2030

- 100% of load to be served by renewable resources by 2040

- 6 GW of PV solar to be installed by 2025

- 3 GW of energy storage to be installed by 2030

- 9 GW of offshore wind to be installed by 2035

All of these initiatives come at a material near-term cost. A June 2020 White Paper issued by the New York Department of Public Service and the New York State Energy Research and Development Authority confirms the state’s continued commitment to meet these aggressive goals. The report also confirmed that one of the greatest challenges is the lack of renewable generation near the state’s load center, New York City. The White Paper suggested that one solution may be to use qualifying electricity generated by hydro plants in Canada and imported directly into to New York City as “renewable power”. If adopted, this will create a significant new carbon-free resource. This is a big win for the Champlain Hudson Power Express (CHPE) line, a transmission project under development to bring power to New York City from hydro dams in Canada. For clients with base loads in excess of 20MWs, a long-term contract to purchase renewable power generated through the CHPE line is an interesting proposition.

Offshore Wind: Even with CHPE, New York cannot meet its renewable goals without offshore wind. Of the 9GWs to be installed by 2035, contracts for only 1.8 GWs of generating capacity have been awarded. In pushing offshore wind, New York is not alone. Almost all Eastern States are dependent on offshore wind to meet their renewable commitments. Current state goals are summarized below.

- Connecticut: 2,000 MWs by 2030

- Maryland: 1,200 MWs by 2030

- Massachusetts: 1,600 MWs by 2027, 3,200 MWs by 2035

- New Jersey: 7,500 MWs by 2030

- New York: 2,400 MWs by 2030, 9,000 MWs by 2035

- Virginia: 2,500 MWs by 2026, 5,200 MWs by 2034

In addition to significant state and local regulatory hurdles, offshore wind projects need federal support from the Bureau of Ocean Energy Management. The level of this federal support is just one energy issue that could be subject to the outcome of the 2020 election.

FERC: WHAT WILL HAPPEN IN NOVEMBER

Numerous issues at FERC are also subject to the political bent of the FERC commissioners.[3] These include PJM’s implementation of FERC’s MOPR order, and the status of net metering.

MOPR: FERC’s MOPR decision in December 2019 continues to frustrate state plans to incentivize carbon-free generation. PJM has made several filings to FERC that seek acceptance of a modified MOPR. However, FERC has yet to rule on these proposals. Not waiting on PJM, in April, New Jersey and Maryland filed a lawsuit challenging the FERC ruling. And if that was not complicated enough, New Jersey, Illinois, and Maryland are all actively considering proposals to leave PJM. The sole Democratic FERC commissioner made it very clear that he strongly opposes FERC’s MOPR ruling and feels that states should have more flexibility to subsidize renewable generation. If Joe Biden wins the election in November, there is a very good chance that FERC would reverse its MOPR ruling.

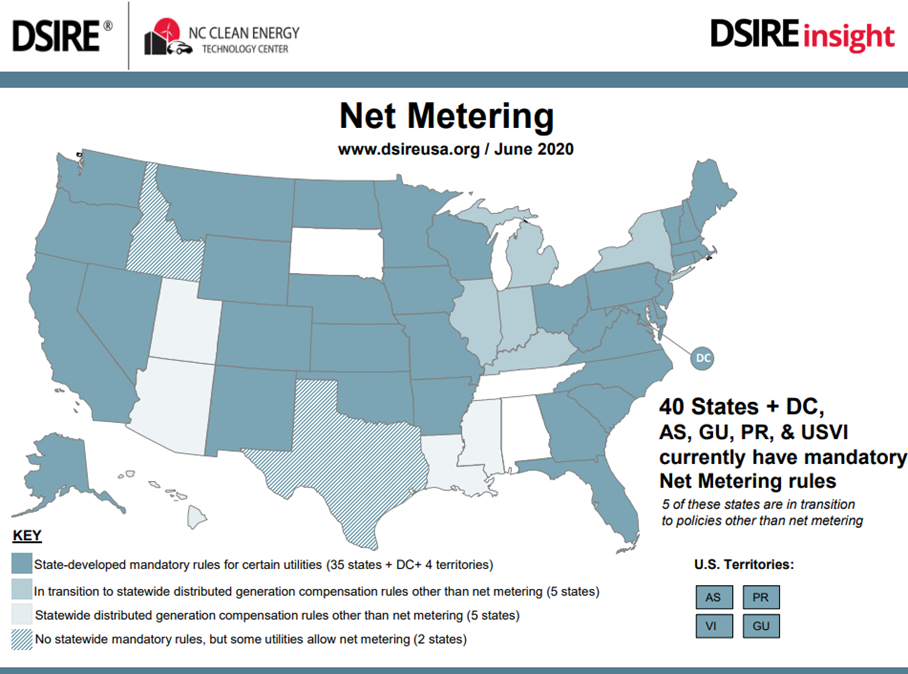

Net Metering: In many markets, net metering is critical to the viability of rooftop solar projects. Net metering typically allows a business or residence to get an annual credit on its electricity bill for onsite solar generation. If a home or business generates more solar power than it uses, the system owner can use that excess generation to offset electricity used at other times when usage exceeds what the panels generate.

As shown in Figure 5, many states use net metering rules as a way of promoting onsite solar energy production.

Figure 5: Net Metering, from dsireusa.org

In April, in an effort to take advantage of a FERC ruling against state subsidies of renewable power, the New England Ratepayers Association (NERA) filed a petition requesting that FERC regulate net metering as a wholesale transaction. This would effectively reverse a 2001 FERC decision that it did not have jurisdiction over net metering. NERA’s motive in trying to establish FERC jurisdiction is to end the effective subsidy provided by net metering. A successful attack on net metering would be very harmful to the economics of many rooftop solar projects. As with the MOPR rule, a Democratic controlled FERC will almost certainly reject this petition. We will continue to monitor these and other issues pending at FERC.

Like many of our clients, our business has been impacted by COVID-19. We understand how important it is to manage costs during periods of economic stress, and we are doing everything we can to help our clients navigate the current energy market. As always, please do not hesitate to contact me or other members of the 5 team if you have energy related questions or you would like to discuss the issues covered in this letter in more detail. Stay safe.