On behalf of the team at 5, I am pleased to forward our first market letter for 2020. Since the spread of COVID-19, our primary concerns have been the safety of our team and supporting our clients. I want to give special thanks to our technology team and its leader, Matt Shaw. Matt planned and executed our multi-year effort to develop an industry leading technology solution, Level5. While we did not build this system with a pandemic in mind, it has allowed us to support clients without interruption during these difficult months. Not surprisingly, this market letter is focused on COVID-19 and its broad and evolving impact on the energy market.

A Black Swan: COVID-19

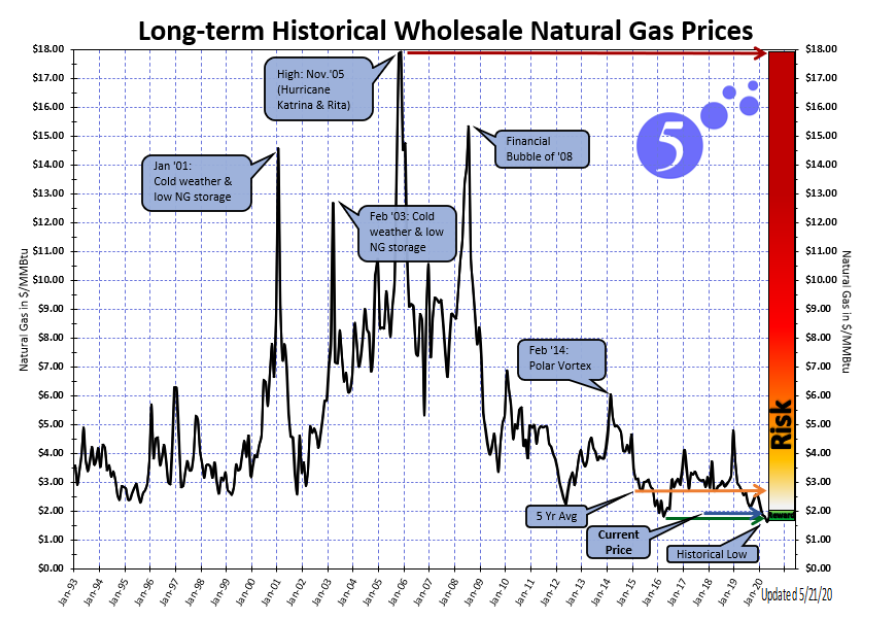

In prior letters, we often referred to the risk of Black Swans – unexpected events that have a dramatic impact on markets. The chart on the following page highlights some of the recent Black Swans and their impact on natural gas prices. These include record cold weather in 2001 and 2003, Hurricanes Rita and Katrina in 2005, the financial collapse of 2008 and the polar vortex of 2014.

These events all look like cygnets (baby swans) when compared to the current pandemic.

When Katrina barreled through the Gulf of Mexico, we had a good idea how long the Gulf’s exploration, production and transportation infrastructure would be out of service. The impact of that hurricane on natural gas prices was significant. However, there was no question that once the infrastructure had been rebuilt, the market would return to normal operation. The same can be said for the other Black Swans noted above, while the market impact was significant, in each case the market changes were relatively short lived. The current pandemic is quite different – it is very difficult to predict the length or scope of the market’s dislocation. If there are material changes in the market, they may take more time to show up. Unable to predict the future, we are focused on what we can learn from the facts. One example is the impact on energy demand.

Figure 1: Long-term Historical Wholesale Natural Gas Prices, by 5

Demand Destruction

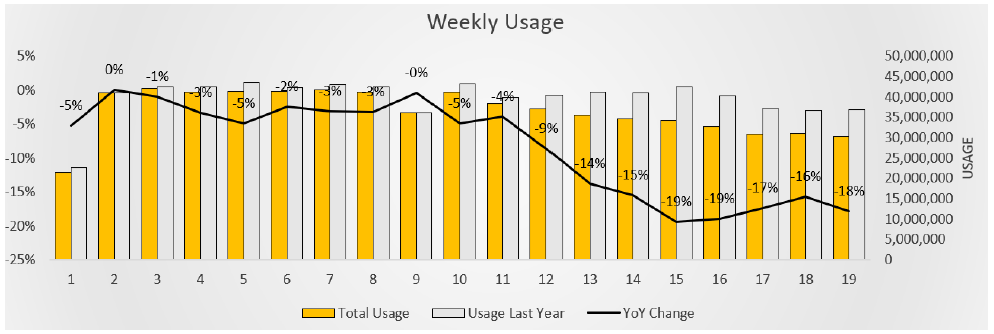

The chart below shows the year over year change in our clients’ usage by week from January 1, 2020 forward.

Figure 2: Weekly Client Usage, by 5

When we break this down by specific customer class, we get a more granular perspective. Load reduction among our clients hit hardest by the virus, such as those in the entertainment industry, are in excess of 70%. Hotels and other hospitality businesses have seen load reductions of 60% or more. At the other extreme, usage at residential apartment buildings (particularly those in New York City) has increased significantly when compared to 2019.

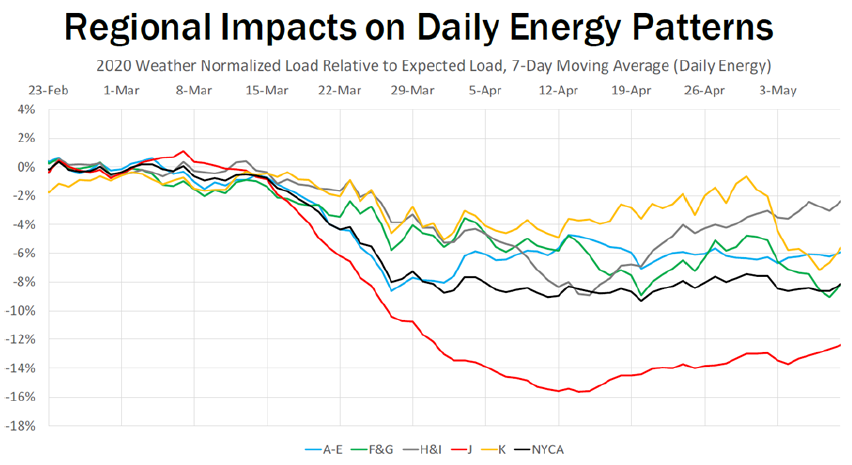

These observations are roughly consistent with data provided by other market participants. The chart below from the NYISO shows demand destruction across the different load zones in New York as of May 9th. Not surprisingly, the most significant drop is in Zone J, the portion of the state that includes New York City.

Figure 3: Regional Impacts on Daily Energy Patterns, by nyiso.com

Recent presentations from some of the larger energy suppliers are consistent. Exelon reported an 8% reduction in load across its customer base, with a 10% to 15% reduction in commercial and industrial load and an increase in residential load by 3 to 7%. NRG broke its load reduction numbers down by region: ERCOT (-2%), PJM (-7%), NYISO (-8%), NEISO (-6%) and CAISO (-9%). NRG’s customer segmentation showed the largest decline in small commercial and industrial load, which was down about 20%. The utility for New York City, ConEd, reported commercial load reduction of approximately 19% and increased residential usage of 11%. We will continue to track these numbers closely and update our energy forecasts accordingly.

Energy Prices

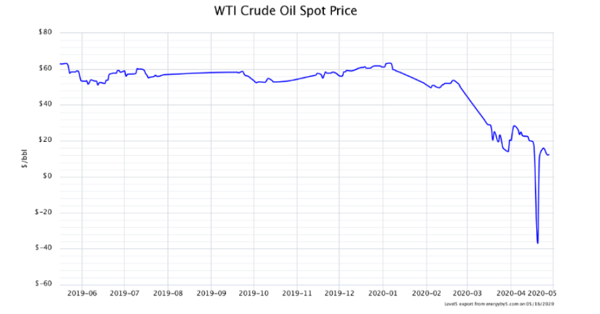

The cut in fuel demand, a spat between Saudi Arabia and Russia, and oil storage levels near their upper limits caused a historic collapse in the spot price of West Texas crude oil. May oil prices dropped 321% in a single day of trading to close at -$40.32 per barrel, the lowest level on record. While oil prices have recovered significantly since then, traders remain jittery.

Figure 4: WTI Crude Oil Spot Price, by 5

Figure 4: WTI Crude Oil Spot Price, by 5

The dramatic drop in the price of oil had the opposite impact on the price of natural gas. Since natural gas, in many cases, is produced as a by-product of oil fracking, the expected decrease in oil production resulted in an initial increase in the price of natural gas. That trend seems to be reversing. As of now, the only material change is an increase in the long-term price of electricity in Texas. This appears to be driven by the market’s fear that new generation may not keep up with the growth in energy demand.

Is Power Plant Development Slowing?

Development of new power plants (primarily wind and solar) may be more difficult to finance due to: (i) tightening markets for debt and equity, and (ii) reduced interest from corporate purchasers of renewable power. Power plant construction requires a significant amount of capital. Project lenders closely analyze energy demand when underwriting the financing of new power plants. These lenders are increasingly concerned that post-COVID-19, demand will not be sufficient to justify new generation. In addition, the tax equity market (investors with taxable income) is important to the financing of many renewable projects that benefit from tax incentives. Early indications from developers are that the appetite from tax equity investors is slowing as the pool of investors with profits to shield declines.

At the same time, corporate demand for large quantities of renewable power, which supported the development of many new plants over the past few years, may wane. We expect to see a decrease in the demand from corporations to purchase renewable power as companies shift their focus to addressing the economic dislocation caused by COVID-19.

The impact of these changes is starting to show up in Texas, where there is a large number of renewable power plants that are to be developed. Vistra (TXU’s parent) stated that they are observing a slowdown in renewable development in Texas, particularly for projects intending to come online in 2021. Vistra noted that if development slows, this could put pressure on reserve margins when/if demand growth returns to pre-pandemic levels. A similar tone was struck by NRG, which pointed to limited amounts of tax equity and low forward prices. These factors are creating the risk that new renewable projects in Texas may not move forward as expected. We will continue to watch the market closely to see if project delays and cancellations are announced.

Contract Language

It is also too early to tell how the pandemic will impact energy contracts. In every stage of the energy market, oil and gas exploration, transportation, power plant construction, transmission, and wholesale and retail supply, there are contracts with force majeure provisions. Many contractual commitments may be excused on the grounds that the pandemic is a force majeure event. A force majeure event is one that is (i) unforeseeable, (ii) outside of the control of the affected party, and (iii) makes contract performance impossible. The risk that contracts are abrogated by force majeure goes well beyond the energy market. For example, do tenants have to pay rent if they cannot occupy a leased office? It will be up to the courts to decide if this pandemic is a force majeure event, and if so, what relief is available to contract counterparties. Again, all we can do at this point is understand that the risk exists and closely monitor future developments.

Conclusion

This is a particularly important time to be an energy advisor. We have been very busy working with all our clients to address short and long-term issues raised by COVID-19. We are all looking forward to the day when the virus’ spread has been halted. Until then, we will be working to mitigate the risk that the pandemic poses to our clients. Please stay safe, and do not hesitate to reach out to us if we can be of help or assistance in the weeks and months ahead.