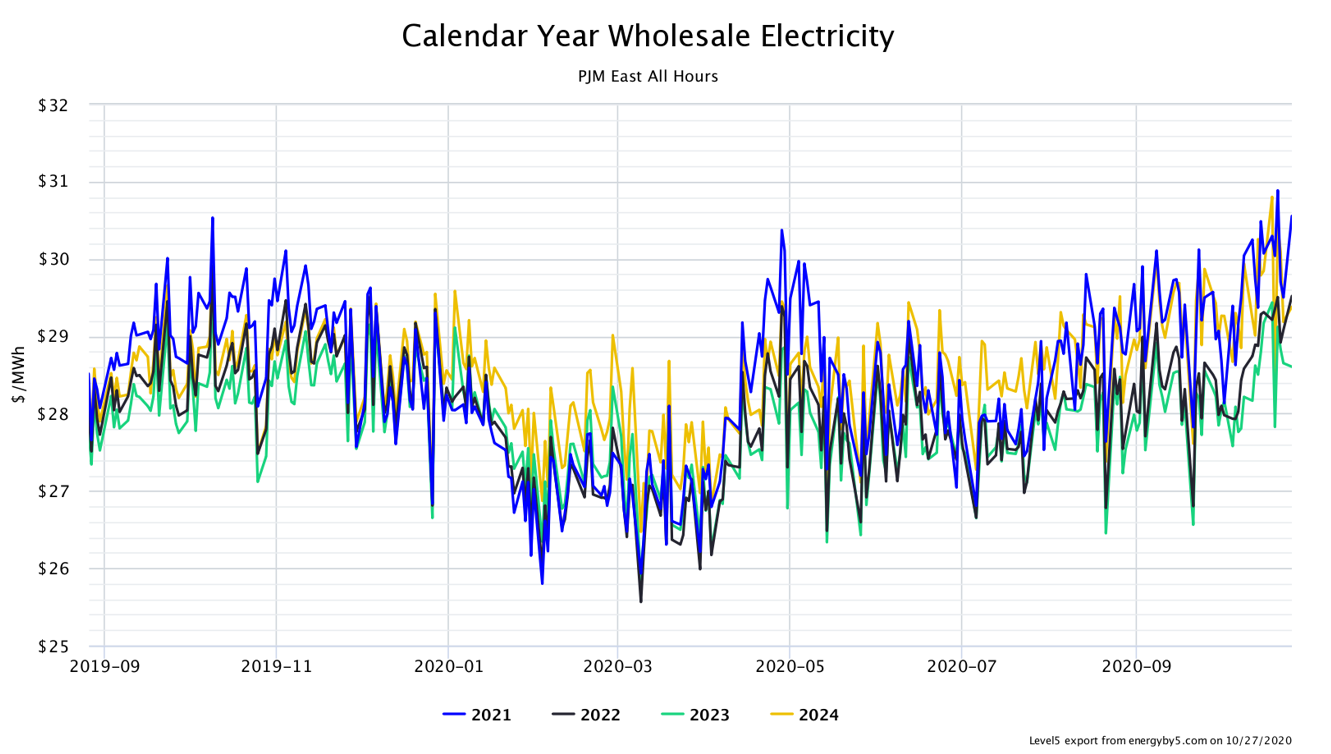

Over the last 4 weeks wholesale electricity futures in PJM have continued to rally. Fueled by bullish near-term natural gas prices, electricity prices have been highly correlated to NYMEX futures. Figure 1 shows that prices in PJM East across all calendar years significantly increased from March through May as the COVID pandemic began to spread. The market fell just as quickly through June and has slowly rallied over the last four months. Since late September prices across all calendar years have risen between 2% and 5% with the biggest increases in calendar year 2021 (blue line) and 2022 (black line). While Figure 1 is specific to eastern PJM, similar trends have been observed in the western parts of PJM.

Figure 1: Calendar Year Wholesale Electricity PJM East from 5

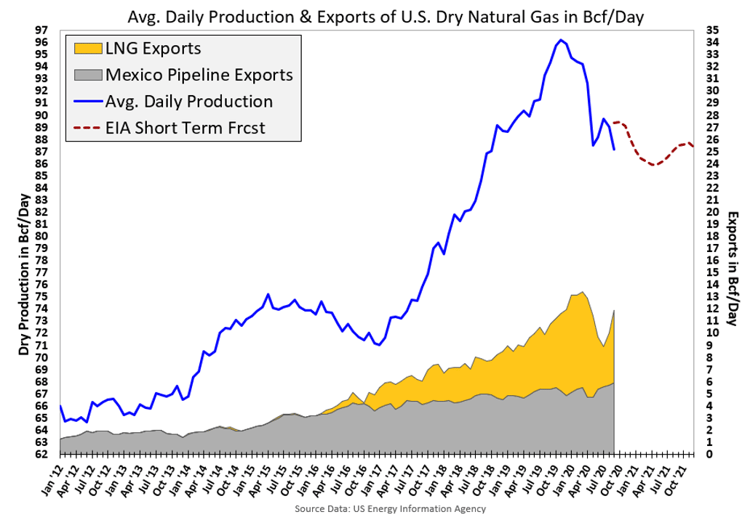

The significant decline in domestic natural gas production is driving the rally in prices for calendar years 2021 and 2022. Figure 2 shows natural gas production rates going back to January 2012. Over the last four years production rates consistently increased, reaching a peak of 96 Bcf/day in January 2020. Destruction in demand coupled with low natural gas prices were the reasons behind the dramatic downturn in production rates. The dashed red line in Figure 2 shows that the US Energy Information Agency expects production rates to continue falling through next year and this belief is pushing electricity prices up in 2021 and 2022.

Figure 2: Avg. Daily Production & Exports of U.S. Dry Natural Gas from eia.gov

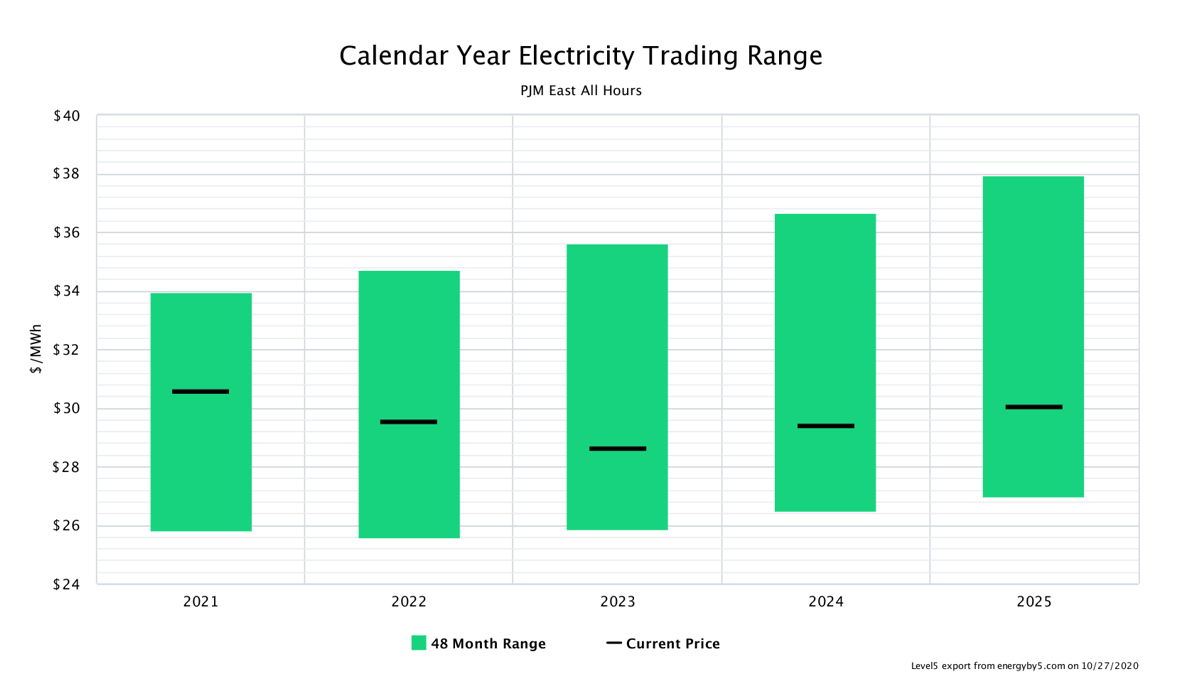

While wholesale electricity prices have continued to rise, some good purchasing opportunities are still present. Figure 3 shows the 48-month forward trading range for wholesale electricity at the PJM East trading hub. The height of the green bar shows the range of low and high prices for electricity in calendar years 2021-2025. The black bar shows where electricity was trading on 10/27/20. There is a slight degree of backwardation (prices decreasing into the future) through calendar year 2023 with a slight premium in 2024 and 2025.

Figure 3: Calendar Year Electricity Trading Range PJM East from 5

Clients with open electricity positions in PJM through 2025 should consider making electricity purchases given that the market is continuing to rally in the short term, it is backwardated through 2023 and relatively “flat” out to 2025. However, traditional fixed-price electricity products may not be the best option for many clients. To generate a fixed-price electricity offer, suppliers will examine historic electricity usage and the peak demand for each electricity account and use that data as the basis for their fixed price. In the wake of the demand destruction that has occurred during the coronavirus pandemic, historic electricity usage and peak demand data are not necessarily indicative of future electricity usage and demand. This article provides more detail as to why clients in PJM should consider other electricity product options.