While aggregation programs like The Texas Coalition for Affordable Power (TCAP) made sense for some cities in the early days of deregulation, these purchasing groups have not been producing the best results for cities for a long time. Cities are now being courted by TCAP to participate in a strategic hedging program that lacks clarity and competition while ultimately removing a city’s ability to reduce and control many aspects of their energy spend.

The Big Picture

The primary goal of TCAP’s program is to reduce the volatility of the energy rates, not to reduce costs. The plan completely removes the influence of energy market movements and regulatory changes from the decision-making process. With constant change in the electricity markets, both from a fuel perspective (i.e., natural gas, renewable) and regulatory perspective, it is foolish not to consider those factors in a city’s energy purchasing decisions. To make matters worse, participating cities hand over all decision-making to TCAP, making it very difficult to quickly change direction when the market dynamics present a better approach.

Missed Opportunity

A strong credit rating is one of the biggest advantages that a city can leverage to gain access to the longer-term contract lengths not typically offered to clients of lesser credit quality. By limiting the hedging term to 24-months, TCAP cities miss out on a few very impactful benefits in today’s market:

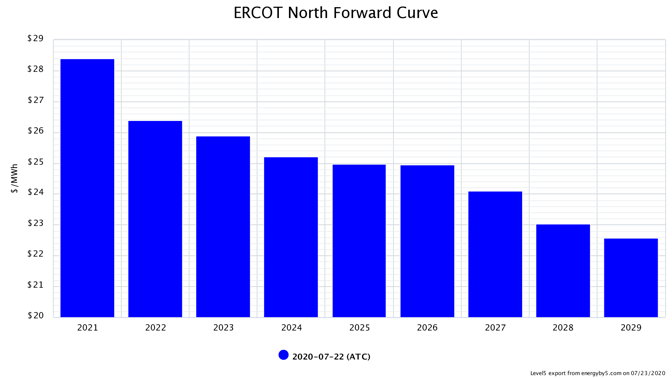

- First, the cost of electricity is significantly lower as term lengths extend into the future as shown in Figure 1 below. While this is not always the case, the current market conditions are presenting a financially compelling reason to consider longer-term contracts.

Figure 1: ERCOT North Forward Curve, from 5

- Second, very low-cost renewable energy options are available in the market. But those options are only available when cities select longer-term contracts.

The TCAP program also limits its wholesale sellers to only 30% participation. This constraint unnecessarily limits low cost generation from broader participation and effectively eliminates a city’s ability to procure 100% renewable energy. Today’s marketplace provides cities the opportunity to both lower cost and achieve sustainability goals without paying additional premiums, but the strategic hedging program from TCAP removes those opportunities from cities.

Lack of Competition

TCAP touts that member cities can opt out of the hedging program and select a fixed price. However, if only one supplier is offering that fixed price, it is not a competitive process and will likely not produce the lowest cost option for the city.

False Market Assumptions

The TCAP program assumes that the forward market is always increasing over time. Not only is this assumption not true today (see Figure 1 above), the ever-changing nature of the market demands a more dynamic approach to procurement than what TCAP is proposing.

Furthermore, the TCAP program claims that it “captures the least expensive gas futures contracts”. The reality is the near-term gas contracts are the most expensive, the exact opposite of TCAP’s claim.

What About Demand Side Costs?

As city budgets continue to get squeezed in a COVID-19 world, reducing costs on the demand side (i.e., utility side) of the bill has become critical. Working with a team that has the expertise and experience (tariff analysis, engineering, energy management, distributed generation) to reduce those costs through mechanisms like 4CP avoidance, power factor correction, peak shaving, and demand response is vital. How have TCAP member cities benefited in these areas to date?

More and more cities are finding that energy advisory services can and should encompass their entire energy spend. Energy advice that comes with confusing product structures lacking transparency along with limited demand side cost reduction services are no longer acceptable.

TCAP’s Strategic Hedging Program is a Bad Deal for Cities

TCAP membership has dropped significantly over the years due to their poor performance. Taxpayers throughout Texas deserve better and we are here to help. Reach out to your energy advisor or contact us to learn more about how to better control your city’s energy spend with clarity and confidence.