The past 12 months have been a wild ride for natural gas producers. Going into last winter, storage was near the 5-year average. And while prices were not great, they were at least near most producer’s costs and most natural gas producers were focused on how to continue to increase production. Recently, those ideas have dramatically changed. A mild winter put significant downward pressure on prices as production was strong, demand was moderate and storage inventory levels were high.

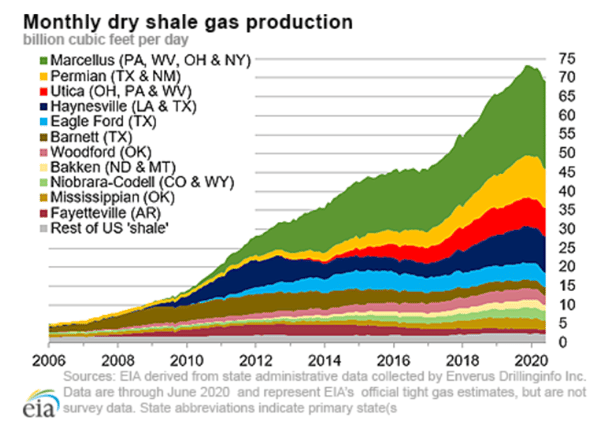

When demand destruction from COVID-19 hit, there was a belief that the drop in crude oil prices would cause oil to be shut in (stop flowing by turning off pumps), which would reduce the amount of associated natural gas that is produced as a by-product of crude production. This decrease did not really materialize. Natural gas production from the Permian Basin in West Texas, the nation’s largest oil reserve and the second-largest natural gas producing reserve (yellow area in Figure 1), is down only 10%, or 1 Bcf per day, since the January 2020 highs.

Figure 1: Monthly Dry Shale Gas Production, from eia.gov

Figure 1 shows that production from the rest of the major natural gas reserves is down just under 3 Bcf per day, for a total decline of about 4 Bcf per day. Overall, natural gas production in the US has only decreased by approximately 5%.

Low natural gas prices are having an impact on production, but that is not what should make gas buyers nervous. Short-term prices are down significantly this summer due to excess supplies. Prices for this winter will also likely see some downward pressure over the next few months as traders wrestle with the possibility of all-time high levels of storage going into late October and early November. The biggest concern for gas buyers is what happens after this winter.

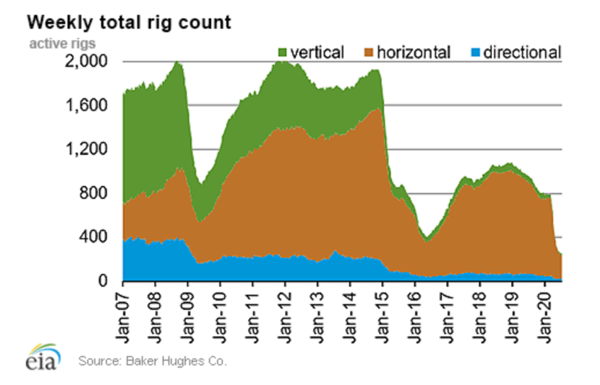

The Total Rig Count, shown in Figure 2, reports on the number of working oil and natural gas drilling rigs in the US every week. This chart shows that the number of active oil and natural gas rigs is down to an all-time low. Compared to this time last year, the number of working natural gas rigs is down 59% to only 71 rigs, while oil rigs are down 77% to 180 rigs. This represents a significant reduction in capital spending by producers. While this production decrease is not likely to affect storage inventories this winter, it could have a material impact on storage further into the future and increase natural gas prices.

Figure 2: Weekly Total Rig Count, from eia.gov

Figure 2: Weekly Total Rig Count, from eia.gov

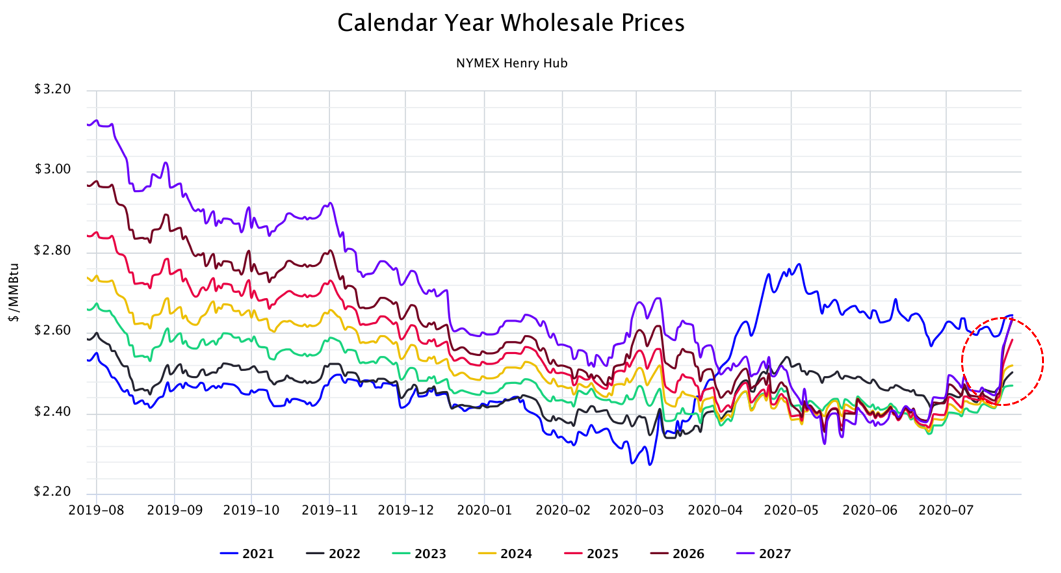

Futures markets have already started to recognize the risk of lower production rates into the future and have started to react. Figure 3 shows natural gas prices for calendar years 2021 through 2027. While prices for 2022 and 2023 have increased, the sharpest rise has been for gas prices in the outer years (2024 to 2027). Even though the increases seem dramatic on the chart, prices are still only 10¢ to 20¢ higher per MMBtu than the low points set in May and June. The bottom line is that while there are bearish forces pushing down natural gas prices through the first half of 2021, there are bullish fundamentals at work for natural gas in the second half of 2021 and beyond.

Figure 3: Calendar Year Wholesale Price NYMEX Henry Hub, from 5