There is often both good and bad news anytime commodity markets are volatile.

The bad news:

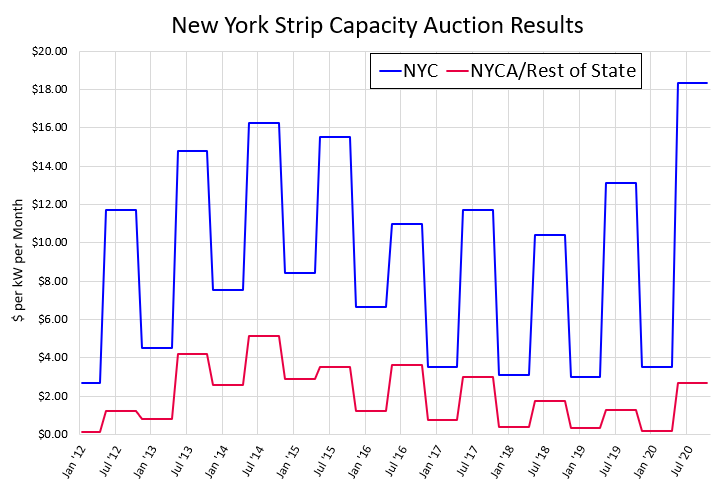

Earlier this month, the NYISO (the entity in charge of economically maintaining the electricity system in New York) completed the first two of three capacity auctions that ultimately set the price paid for capacity in the coming summer months (May – Oct 2020). Many were anticipating higher summer capacity prices (especially in New York City) from this month’s auction given how high forward capacity prices have been. Historical capacity prices for New York City and the rest of New York State are shown in Figure 1.

Before this month’s auction, summer capacity was trading between $17 and $19 per kW-month in New York City and between $2.75 and $3.00 per kW-month for the rest of the state (NYCA in Figure 1). The auction clearing price for the New York City zone settled at $18.36 per kW-month, which is the highest clearing price in the history of the strip auction, while the NYCA zone cleared at $2.71 per kW-month, which is slightly less than the summer of 2017’s auction price.

Figure 1: New York Strip Capacity Auction Results, by 5

Figure 1: New York Strip Capacity Auction Results, by 5

This auction outcome does not directly translate into the price of capacity that is factored into default utility tariffs or what third-party suppliers will charge for capacity in their retail electricity prices. However, it is a very strong leading indicator of higher electricity costs in the future. The magnitude of these higher prices becomes obvious when converting the auction clearing prices from the units of dollars per kW-month into dollars per kWh. For a typical large commercial office building in New York City, with a load factor of 50%, these capacity prices will amount to approximately 4.2¢ per kWh for the 6-month period of May to October 2020, roughly 50% of the total retail electricity rate. Capacity is only one component of a retail electricity price. The other major component is the wholesale price of electricity and this is where there is some good news for electricity buyers.

The good news:

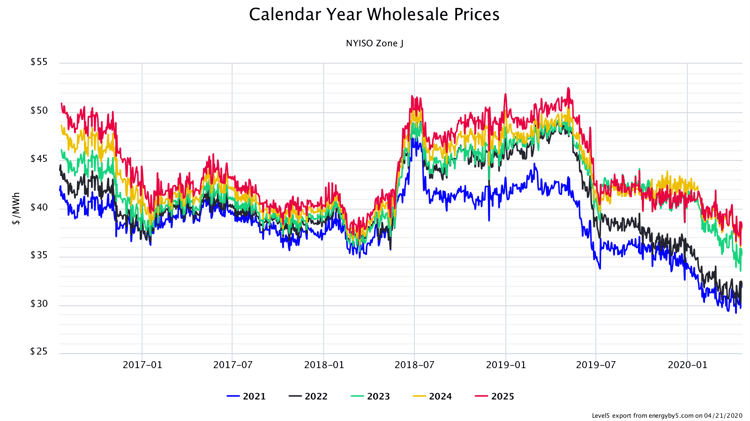

Wholesale power prices in New York City and throughout the state are still trending lower. Historical wholesale electricity prices in New York City for calendar years 2021 to 2025 over the last four years are shown in Figure 2. This chart shows that prices for calendar years 2021 and 2022 (the blue and black lines in Figure 2) are near their multi-year lows of around $30 per MWh (3¢ per kWh).

Figure 2: Calendar Year Wholesale Prices NYISO Zone J, by 5

Figure 2: Calendar Year Wholesale Prices NYISO Zone J, by 5

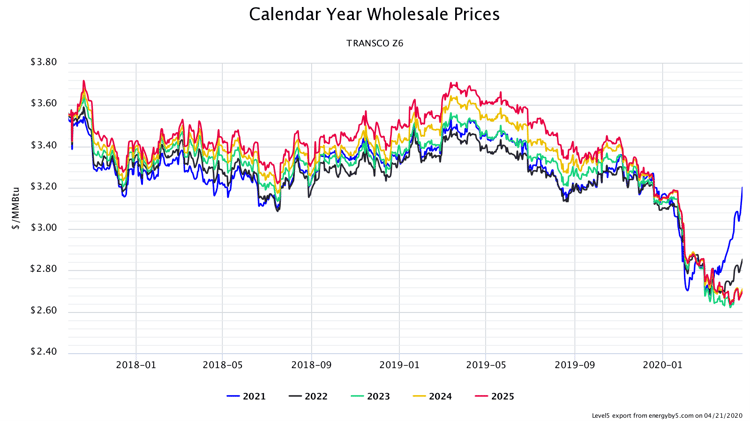

These very inexpensive wholesale power prices make a fully bundled retail offer still attractive, even with record-high capacity charges. The largest risk to these low wholesale power prices is the recent and rapid increase in New York City natural gas prices for 2021 and 2022. Historical gas prices in New York City for calendar years 2021 to 2025 over the last 30 months are shown in Figure 3. This chart shows that in the last four weeks, gas prices for calendar years 2021 and 2022 have risen dramatically (see blue and black lines in Figure 3). With crude oil prices falling sharply, the recent rally in natural gas prices will begin to put substantial upward pressure on wholesale power prices in New York. If this recent rally in natural gas prices starts to turn wholesale power prices upward, the silver lining to higher capacity prices could start to fade and rapidly rising retail electricity prices will be all that is left.

Figure 3: Calendar Year Wholesale Prices NYISO Zone J, by 5

Figure 3: Calendar Year Wholesale Prices NYISO Zone J, by 5

NYC Annual Benchmark Reporting Deadline Extended

New York City Local Law 84 of 2009 and Local Law 133 of 2016 requires owners of covered buildings to submit energy and water consumption data annually by May 1st. City officials are allowing building owners who are unable to submit their CY2019 benchmarking information by May 1, 2020 to submit those reports by August 1, 2020 without penalty. More information about the extension of this deadline can be found here.